As we enter the fall season of 2024, the Portland Metro real estate market continues to evolve, presenting a complex and nuanced landscape for buyers, sellers, and investors alike. This comprehensive market update will delve into the latest statistics and trends shaping the real estate scene in one of the Pacific Northwest’s most vibrant metropolitan areas. From inventory levels to pricing trends and sales activity, we’ll explore what these numbers mean for various stakeholders in the market and what we might expect in the coming months.

Inventory and Listings: A Closer Look

Rising Inventory Levels

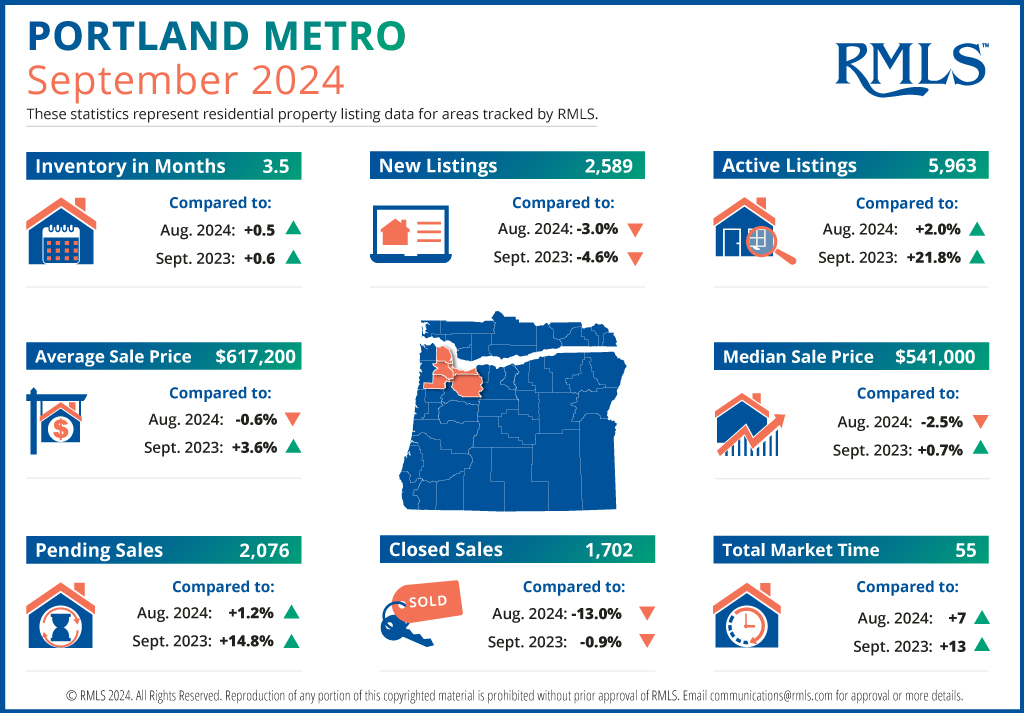

One of the most significant shifts in the Portland Metro real estate market is the notable increase in inventory. As of September 2024, the months of inventory have risen to 3.5, marking a 0.6 increase from the previous year and a 0.5 increase from just last month. This metric is crucial as it indicates how long it would take to sell all current listings at the current sales pace if no new homes came on the market.

This increase in inventory is a welcome change for buyers who have faced tight market conditions in recent years. With more options available, buyers can take more time to find the right property and may face less competition in bidding situations. For sellers, however, this shift means potentially longer selling times and the need for more competitive pricing strategies.

Active Listings on the Rise

Further illustrating the inventory growth is the number of active listings, which stands at 5,963 as of September. This represents a substantial 21.8% increase from the same time last year and a 2% uptick from the previous month. This growth in active listings contributes to the increased months of inventory and provides a broader selection for potential buyers.

The rise in active listings could be attributed to various factors, including:

1. Homeowners feeling more confident about listing their properties in a stabilizing market

2. New construction projects coming to completion

3. Some investors potentially offloading properties in response to market conditions or changes in investment strategies

New Listings: A Slight Decline

Interestingly, while overall inventory is up, new listings have seen a slight decline. September brought 2,589 new listings to the market, down 4.6% compared to last year and 3% from the previous month. This decrease in new listings presents an intriguing contrast to the overall inventory growth and could suggest several possibilities:

1. Some potential sellers may be adopting a “wait and see” approach, holding off on listing their homes due to market uncertainties or hoping for more favorable conditions.

2. The pool of homeowners ready to sell may be temporarily diminished after a period of high activity.

3. Seasonal factors could be influencing listing decisions, as fall typically sees a slowdown in new listings compared to the spring and summer months.

Pricing Trends: Stability Amidst Change

Average Sales Price

The average sales price in the Portland Metro area stands at $617,200 as of September 2024. This figure represents a 3.6% increase from the previous year, indicating continued appreciation in the market. However, it’s worth noting that this price is down 0.6% from the previous month, suggesting a slight cooling or stabilization in the short term.

The year-over-year increase in average sales price points to the overall health and desirability of the Portland Metro real estate market. Factors contributing to this sustained growth might include:

1. The region’s continued economic development and job market strength

2. Portland’s enduring appeal as a livable city with diverse cultural offerings

3. Limited land availability within the urban growth boundary, which can drive up prices

The slight month-to-month decrease, while minor, could be an early indicator of a market reaching a plateau or responding to increased inventory levels.

Median Sales Price

The median sales price, often considered a more stable indicator as it’s less influenced by extremely high or low outliers, sits at $541,000. This represents a modest 0.7% increase from the previous year but a more noticeable 2.5% decrease from last month.

The minimal year-over-year growth in median price, coupled with the more substantial month-to-month decrease, could suggest:

1. A market that’s finding equilibrium after periods of rapid growth

2. Increased inventory giving buyers more negotiating power

3. A potential shift in the types of homes being sold, with more mid-range properties changing hands

Sales Activity: A Tale of Pending and Closed Sales

Pending Sales on the Rise

One of the most encouraging signs in the September 2024 data is the increase in pending sales. With 2,076 pending sales reported, we’re seeing a robust 14.8% increase from the same time last year and a 1.2% uptick from the previous month. This growth in pending sales is a positive indicator of market activity and buyer interest.

The rise in pending sales could be attributed to several factors:

1. Buyers taking advantage of the increased inventory to find homes that meet their criteria

2. Potential concerns about future interest rate changes motivating buyers to act

3. Seasonal factors, as some buyers aim to close before the holiday season or end of the year

Closed Sales: A Slight Dip

In contrast to the rise in pending sales, closed sales have seen a slight decrease. September recorded 1,702 closed sales, down 0.9% from the previous year and a more substantial 13% from the previous month. This divergence between pending and closed sales is intriguing and could indicate:

1. A lag effect, where the increase in pending sales may translate to higher closed sales in coming months

2. Potential challenges in the closing process, such as financing issues or inspection concerns

3. A mismatch between buyer expectations and market realities, leading to some deals falling through

The decrease in closed sales, particularly the month-to-month drop, warrants close observation in the coming months to determine if it’s a temporary fluctuation or the beginning of a trend.

Market Dynamics: Extended Time on Market

A key metric that has seen significant change is the total market time, which has extended to 55 days. This represents an increase of 13 days from the same time last year and 7 days from just last month. This lengthening of time on market aligns with the increased inventory levels and provides several insights:

1. Buyers have more time to make decisions, potentially leading to more thoughtful purchases and less frenzied bidding

2. Sellers may need to adjust their expectations regarding how quickly their properties will sell

3. The market may be shifting towards more balanced conditions, moving away from the seller’s market that has dominated in recent years

Implications for Market Participants

For Buyers

The current market conditions present several opportunities for potential homebuyers in the Portland Metro area:

1. More Options: With increased inventory and longer market times, buyers have a wider selection of properties to choose from and more time to make decisions.

2. Potential for Negotiation: The slight cooling in prices, especially month-to-month, may provide room for negotiation on price and terms.

3. Less Competition: While pending sales are up, the overall increase in inventory may mean less competition for individual properties.

4. Opportunity for Due Diligence: Longer market times allow for more thorough inspections and consideration of properties.

However, buyers should also be aware of potential challenges:

1. Interest Rate Considerations: While not directly reflected in these statistics, interest rates play a crucial role in affordability and should be closely monitored.

2. Price Stability: Despite some month-to-month decreases, overall prices remain higher than last year, and significant bargains may still be rare.

For Sellers

Sellers in the Portland Metro market face a more complex landscape:

1. Pricing Strategy is Crucial: With more inventory and longer market times, accurate and competitive pricing is more important than ever.

2. Preparation and Presentation: Homes must be well-prepared and presented to stand out in a market with more options for buyers.

3. Patience May Be Necessary: Sellers should be prepared for potentially longer selling times compared to recent years.

4. Opportunities Still Exist: The increase in pending sales suggests that well-priced, attractive properties are still generating significant interest.

Sellers should work closely with their real estate professionals to develop strategies that take into account these changing market dynamics.

Looking Ahead: What to Watch

As we move further into fall and approach the winter months, several factors will be crucial to watch:

1. Inventory Levels: Will the trend of increasing inventory continue, or will it stabilize?

2. Price Trends: How will the slight cooling in prices play out over the coming months?

3. Sales Activity: Will the increase in pending sales translate to higher closed sales, or will we see a continued divergence?

4. Seasonal Factors: How will the typical seasonal slowdown in real estate activity impact these trends?

5. Economic Indicators: Broader economic factors, including job market health and interest rates, will continue to play a significant role in shaping the real estate market.

Conclusion

The Portland Metro real estate market in September 2024 presents a landscape of both opportunity and complexity. The increase in inventory and longer market times suggest a move towards more balanced conditions, offering benefits for buyers while presenting challenges for sellers. The rise in pending sales indicates ongoing strong interest in the market, even as closed sales have seen a slight dip.

For buyers, this market offers more choices and potentially more negotiating power, but it also requires careful consideration of long-term value and affordability. Sellers, while facing more competition, can still find success with the right strategy, pricing, and presentation.

As always, real estate remains local, and conditions can vary significantly between different neighborhoods and property types within the Portland Metro area. Working with knowledgeable real estate professionals who understand these nuances is crucial for both buyers and sellers navigating this evolving market.

The coming months will be telling as we see how these trends develop and how the market adjusts to changing conditions. Whether you’re looking to buy, sell, or simply understand the market better, staying informed about these trends and working with experienced professionals will be key to making sound real estate decisions in the Portland Metro area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link